If you have any upcoming research projects that I can help with, please email me at

james.alford@unabashedresearch.com or call 1-206-429-9112 and ask to speak to a representative.

I prefer to charge a flat fee per contract based on the scope of the research needed. Also, please keep in mind that third party expenses may increase project costs. Examples include paying for general population sample survey completions, survey authoring software licensing fees, gratuities for qualitative research participants, focus group research facilities, and so on.

My Approach

I'm a believer that research should be specific and actionable. Before engaging in any research, I like to have a "drill-down" meeting with key stakeholders to learn more about the research needs.

1. What are the research goals?

2. Why are these the research goals? In other words, what business metrics if any will this research inform? How will knowing this improve your business?

3. How will the research be used? What business decisions will this research inform?

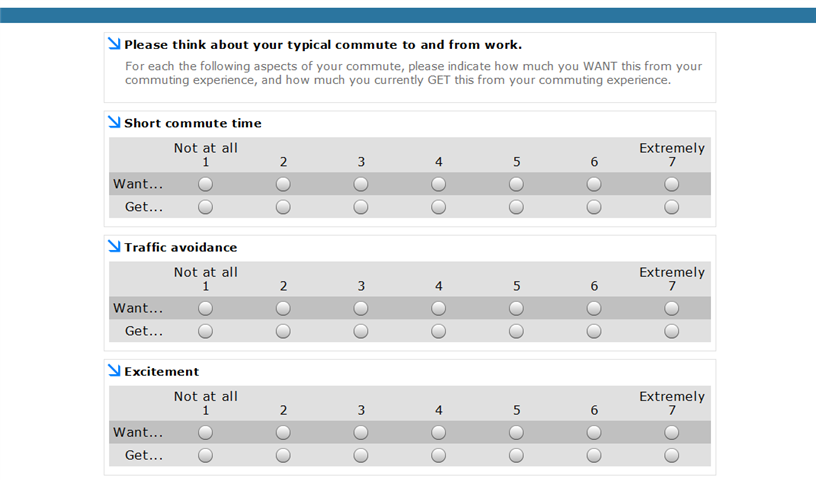

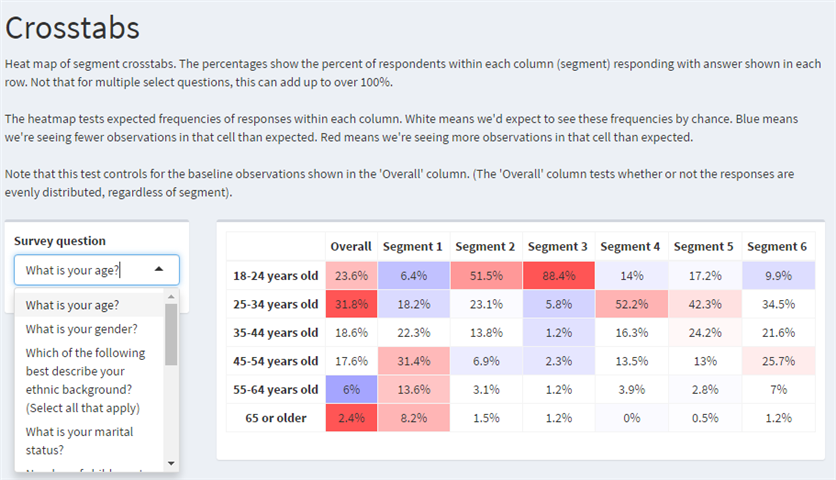

I often find that clients expect research to deliver a one-off snapshot of their customers, a report detailing the descriptive statistics of their customers and their responses in the form of crosstabs and bar charts.

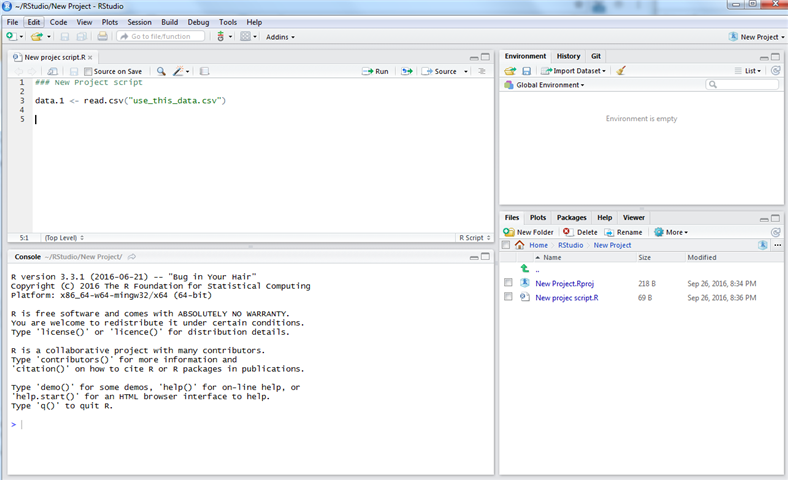

But more often than not, when given the opportunity, what clients would really like is to be able to predict changes in business metrics based on "what-if" scenarios. So if we start the WHY of the research, we work backwards. What would we like to predict -> what data do we need to build a predictive statistical model -> build survey around getting the needed data.

I've found this approach successful in delivering research findings that are immediately actionable and impactful.

Testimonials

I have had the pleasure of working with James, Founder and Principal of Unabashed Research, side-by-side at a previous company. James is not only a top-notch professional with a set of extremely rare analytical skills, but also someone who can explain very complex technical concepts in a simple and easy to understand way. His professionalism and work ethic are unparalleled.

Zappos hired James and Unabashed Research to partner in conducting some extremely important and pivotal market research at a time when Zappos was transitioning to a new business strategy. James stepped up and delivered end-to-end results in an astonishingly compressed time frame – 5 weeks from research conception to final deliverables. This speed of delivery is quite unique, compared to 12 to 15 weeks turnaround time for most full-service market research companies.

The results of the research James conducted were used to form the new Zappos strategy and are now continually used to focus the company on key customer segments.

I would work with James and Unabashed Research again in a heartbeat.

Alex Genov

Head of UX Research

Zappos Family of Companies

About

After receiving my doctorate in Cognitive Neuroscience in 2006 from the University of Oregon, I began to apply my skills to the corporate world. I consulted at Microsoft Hardware as a quantitative user researcher until 2011, when I left to accept a full time position as the in-house market researcher for Active Network. After being asked to relocate in 2014 when the local office was downsized, I decided it was time to move on. A short time later, I was asked to consult on a major market segmentation project and Unabashed Research was born!