You’re in a highly competitive industry. Not only does the next version of your product need to offer more value to end users than your current version, but it needs to outperform your competitors as well. User research has identified new feature concepts that your customers are responsive to. Incremental improvements in existing features are also an option. Which version of the product should you go to market with? Which version would win you market share versus your competitors? Which version would bring in the most additional revenue? If this describes your situation, then you might benefit from Choice Based Conjoint Analysis (CBC).

How it works

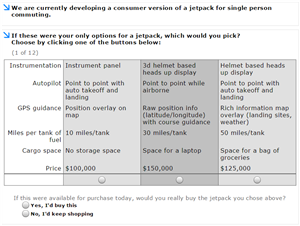

CBC is a survey methodology that closely resembles real-world purchase decisions. Survey respondents are shown a number of product concepts, usually three at a time, and asked to indicate which concept they prefer most. Each product concept is defined by a combination of attributes. For example, a laptop has brand, size, weight, processor speed, RAM, disk space, and price. Each of these attributes has different ways they can be built into the final product, called features. Feature levels of the brand attribute might be Dell, IBM, Lenovo, or HP laptop. Feature levels of the RAM attribute might have 4, 6, 8, or 10 GB of RAM.

Because the respondent is asked to indicate which combination of features they most prefer, this allows us to build a statistical model that predicts product preference based on what features a hypothetical laptop has. This is referred to as preference share. Some CBC versions follow up the preference survey question with a purchase intent question, such as “if the product you selected above were available in the market today, would you buy it at this time?”. This is called purchase share and is used as a proxy for market share.

I use Sawtooth Software to design and program CBC surveys. Click here for a short video that helps explain the benefits of this methodology.

Pros:

-

The best way to predict how customers will respond to a product concept is to mimic the purchase decision. CBC successfully does this, and has a long history of accurately predicting how product concepts will perform in the real world.

-

When price is included as a product attribute, the added value of specific features can be estimated. When this information is combined with production cost estimates, businesses can go to market with products that users value while maximizing profits. For new product concepts, the benefit or “user story” of the feature can be used as the feature description. With price included, the value add of a novel value proposition can be estimated.

Cons:

-

CBC can be challenging for the survey respondent. It typically takes 5-10 minutes for a respondent to complete a CBC section of a survey because they are asked to make complicated trade-offs to decide which product versions they prefer. For example, how much is an extra 2GB of RAM worth? Are customers willing to choose a cheaper laptop if it’s a Dell even though they prefer HP? Because of the cognitive load of these types of questions, respondent attrition can be higher than other surveys.

-

Best results are obtained with around five to eight attributes, with around three to five mutually exclusive feature levels within each product attribute. Sometimes products don’t conform to this structure, such as some software where product attribute feature levels are essentially the presence or absence of new functionality being developed.

-

CBC is excellent at what it’s designed to do, but it isn’t designed to address other subtleties in product research. Was a product configuration rejected because it didn’t have a must-have feature, or maybe it had a feature that was unacceptable? Which respondents think the product concept is a bargain at a certain price point, or getting expensive? Because respondents aren’t necessarily willing to pay more for a feature, does that mean it doesn’t add value? Customer service, for example, can add value to the overall user experience and lead to word-of-mouth recommendations, but consumers might be unwilling to pay more for better service.